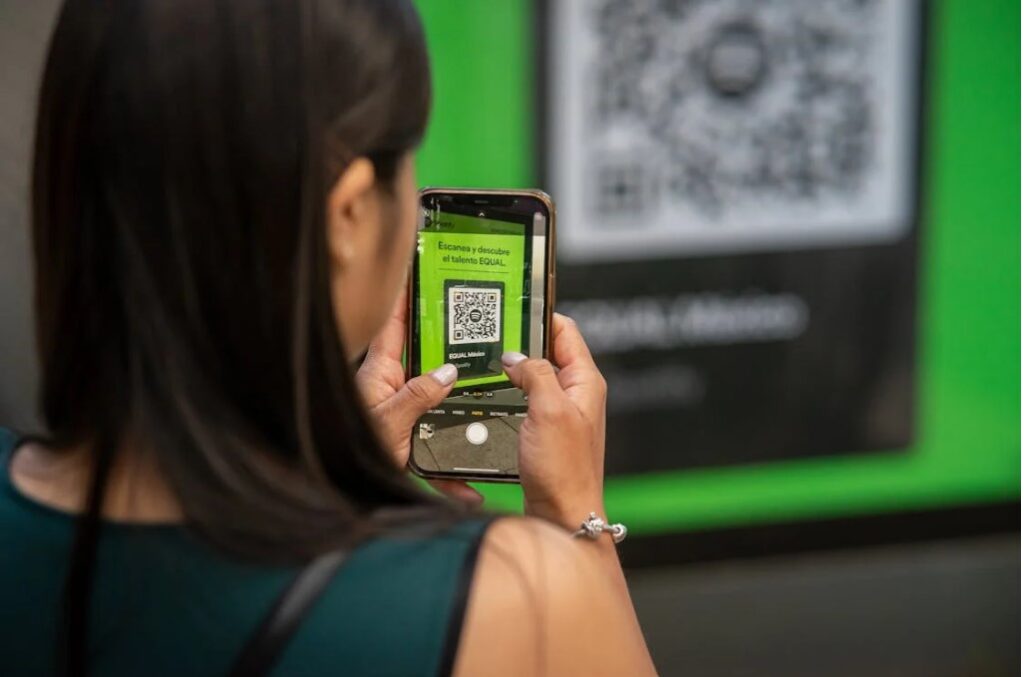

Pune Police Officer Loses Rs 2.3 Lakh After Scanning QR Code at Local Bakery

Pune Police Officer Loses Rs 2.3 Lakh After Scanning QR Code at Local Bakery(Representative image

Pune News : Another shocking incident happened in Pune. A Pune Police Officer Loses Rs 2.3 Lakh when he scanned QR code. The constable, who lives in Saswad near Pune, reported the incident to the Pune rural police. According to a report, the scam began when he tried to pay a bill at a bakery in Saswad. He was asked to scan a QR code to complete the payment. Soon after, he noticed Rs 18,755 had been taken from his savings account without his permission. He got worried and checked his other account and found out Rs 12,250 taken out from his salary account.

The situation got more worried when the constable received an OTP notification, for a transaction of Rs 1.9 lakh from his gold loan account. Even though he did not share the OTP, the transaction was still completed. The scammer also tried to make two more transactions of Rs 14,000 using his credit card details. However luckily, the constable quickly blocked his bank accounts and credit card.

The police investigation is still ongoing. The police said that the scammer got the access to the constable’s phone through a harmful APK file. The police are suspecting that the constable may have clicked on a suspicious link sent by the scammer. Which might have installed malware on his phone. This malware might allowed the criminals to steal the sensitive information like login details and OTPs.

The police are still finding whether the QR code was faulty which allowed scammer to gain the phone access or if the fraudsters used other tricks.

As digital payments become more common, it’s important to protect yourself from such scams.

Here are some safety tips:

Verify QR codes: Before paying with a QR code, make sure the person you’re paying is trustworthy. Avoid scanning codes from unknown or suspicious places.

Check the receiver’s name: Always confirm the receiver’s name when you scan a QR code.

Avoid suspicious links: Don’t click on links sent in unsolicited text messages, emails, or social media. These links may lead to phishing websites or install harmful software on your phone.

Use official apps: Always use official and trusted apps for payments. Download apps only from trusted sources like Google Play Store or Apple App Store.

Also Read, How a Retired Bank Officer From Pune Scammed of Rs 33 Lakh Through a Facebook Credit Card Link